Economic pressures will hit sector over the coming years following a 'false high' of COVID-19 projects, says Glenigan market report

The healthcare construction sector will experience a period of uncertainty in the coming years as economic pressures and the fallout from the COVID-19 pandemic continue to bite.

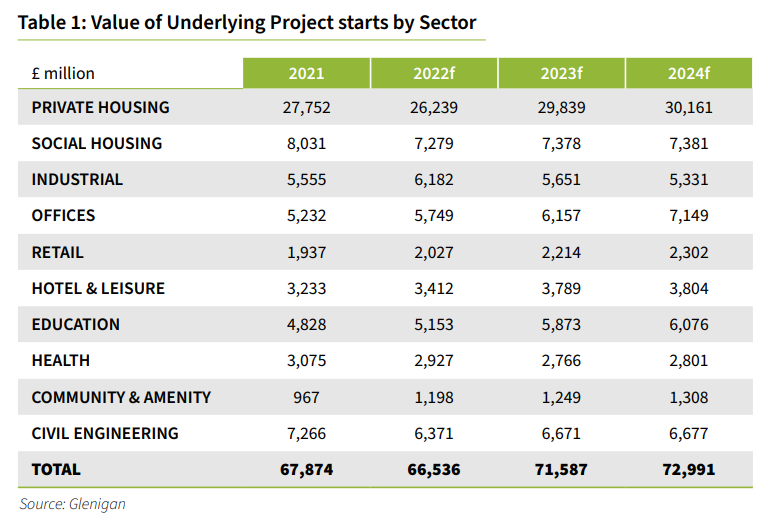

According to Glenigan’s newly-released UK Construction Industry Forecast 2022-2024, investment in public-sector projects, including the plan to build 40 new hospitals, is set to be an important driver for construction activity moving forward.

In the health sector, project starts remained high in 2021 post pandemic and the increase in capital funding and a growing development pipeline means the value of starts are expected to remain steady over the forecast period, will slight declines this year (-5%) and next (-6%) before picking up slightly in 2024.

Commenting on the figures, Glenigan’s economic director, Allan Wilen, said: “There was a slight decline in healthcare starts in 2022/23 because the sector had seen substantial growth, with huge investment in Nightingale hospitals at the start of the pandemic, which created a false high and threshold for the sector going forward.

“But NHS trusts are bringing forward new projects and investment plans and the sector is seen as an area of opportunity.”

The pinch is starting to bite

But, across all sectors, the predicted activity is happening against a backdrop of economic pressures, including COVID, the fallout from Brexit, the Russian/Ukraine conflict, and ongoing material and labour shortages.

Speaking at a recent Glenigan webinar to discuss the implications of the report, Richard Ellithorne, membership services director at the Builders Merchants Federation (BMF), explained: “Material price inflation is up by 23%, particularly concrete prices have gone up by nearly 62%, with one supplier putting in place four price increases this year alone.

Contractors are being more selective in the contracts they tender for as they balance a desire for work and the greater risks, and this will play into next year

“The pinch is really starting to bite.

“Supply sales were down on timber and joinery between April 2021 and 2022, but tool hire is going well, suggesting builders are hiring, rather and buying kit.”

Robert Davis, Glenigan’s content director, added: “Material costs are unprecedented and there are additional pressures coming from the labour side, with 50,000 new construction workers needed.

“Because of this, contractors are being more selective in the contracts they tender for as they balance a desire for work and the greater risks, and this will play into next year.

“Tender prices will rise by 9% over the next two years and energy and oil prices are also increasing.”

The impact of this is that the cost of construction is expected to increase and, the report warns, this could mean projects being cut back or shelved altogether.

A balancing act

Davis said: “Building costs are expected to rise by 7% this year and by 2% and 3% in 2023 and 2024 respectively, so there is no let up.”

Ellithorne added: “It will be a balancing act.

“There are opportunities there, but we would say to contractors that when they speak to customers, be realistic about lead times, rather than overpromise and underdeliver.

“It’s about managing expectations.

“Give a realistic price for work when quoting, rather than hitting the client with a 25% increase at the end.”

This situation will no doubt encourage a burst of imagination and innovation which will see the sector weather the current storm and progress to, if not sunny uplands, then at least towards a trajectory of upward growth

Wilen agreed, saying: “There are pressures to build order books at any price, but you have got to think about the risks.

“I would advise identifying areas of growth, such as government sector projects like healthcare, then look at your current skill set and maybe look to bring in new skills.

“There are opportunities, but it’s important to plan ahead and build in some flexibility as clients may have to reappraise funding or might not be moving forward with projects as you expect.”

Managing expectations

Across all sectors, the report shows that, while growth will be stifled this year (-2%), 2023 is predicted to see a modest 8% increase in project starts, and a smaller 2% lift in 2024, representing an average rise of 2.6% over the forecast period.

This report is predominantly focused on underlying starts (under £100m in value).

Wilen said: “Circumstances have changed significantly since the November 2021 forecast and, while the short-term picture appears challenging, we should adopt a sanguine approach for the next few years.

“Markets sent into turmoil by the Russia/Ukraine War are starting to stabilise as new supply chain solutions are developed and established.

“Of course, in the near future construction and building product costs will remain high. However, this situation will no doubt encourage a burst of imagination and innovation which will see the sector weather the current storm and progress to, if not sunny uplands, then at least towards a trajectory of upward growth."